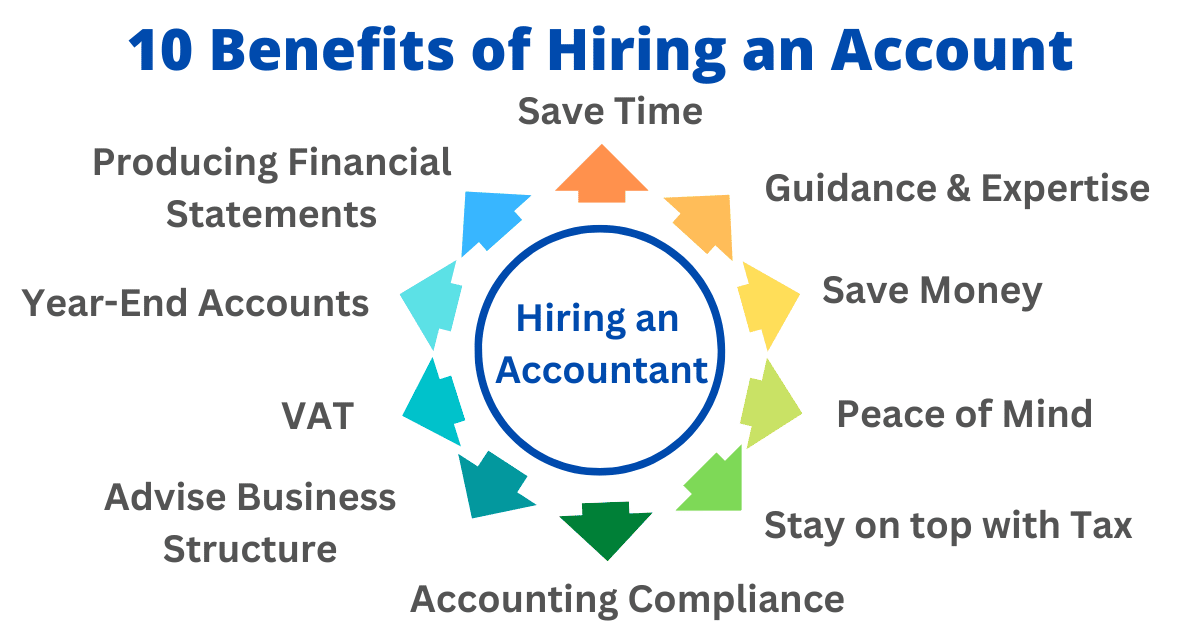

Why UK Small Businesses, Freelancers & Startups Need Professional Accounting Support

Running a business in the UK requires strategy, consistency, and smart decision-making. But one of the biggest mistakes small business owners make is trying to manage every part of the business alone — especially the financial side.

If bookkeeping, tax returns, or HMRC paperwork often leave you overwhelmed, you’re not alone. Thousands of UK small businesses eventually realise one important truth:

A good accountant doesn’t just file taxes — they help your business grow.

At TT Accountancy Services (TTAS), we’ve supported freelancers, landlords, sole traders, and limited companies across London and the UK. Here’s exactly how an accountant can save you time, reduce stress, and help you build a more profitable business.

1. Saving You Hours of Administrative Work

Business owners spend an average of 10–20 hours per month sorting invoices, receipts, books, and HMRC requirements.

An accountant takes all of that off your plate by handling:

- Bookkeeping

- Payroll

- VAT returns

- Self-Assessment tax returns

- Corporation Tax filing

- HMRC correspondence

- Year-end accounts

These tasks run quietly in the background while you focus on clients, revenue, and growth — not spreadsheets.

2. Ensuring You Stay Fully HMRC-Compliant

HMRC requirements are constantly changing, and missing a step can be expensive.

An accountant helps you stay compliant with:

- Tax deadlines

- VAT rules

- PAYE and payroll

- Making Tax Digital (MTD)

- Allowable expenses

- Filing requirements

- HMRC record-keeping rules

This reduces your risk of fines, penalties, or HMRC investigations.

3. Helping You Save Money Through Smart Tax Planning

A good accountant does more than calculate your tax — they help reduce it legally.

TTAS helps clients save money through:

✔ Claiming all allowable expenses

✔ Choosing the right business structure

✔ VAT scheme selection

✔ Salary and dividend planning

✔ Capital allowances

✔ Business tax reliefs

✔ Landlord and property tax optimisation

Smarter tax planning means higher profits and less stress.

4. Providing Clarity on Your Business Finances

Many small businesses operate without a clear financial picture.

An accountant provides:

- Profit & loss analysis

- Cashflow forecasting

- Budgeting support

- Financial reporting

- Performance tracking

These insights help you make better decisions — from pricing to hiring to expansion.

5. Guiding Your Business Growth Strategy

If you’re planning to grow your business in the UK, an accountant becomes even more essential.

TTAS helps businesses scale by offering:

- Advice on funding and loans

- Feasibility and growth analysis

- Business planning

- Hiring and payroll planning

- VAT registration decisions

- Expense control and budgeting

Growth becomes easier when your finances are stable and strategic.

6. Managing Payroll So You Avoid Mistakes

Running payroll involves strict HMRC rules and monthly deadlines.

An accountant ensures:

✔ Correct PAYE deductions

✔ Timely RTI submissions

✔ Pension calculations

✔ Statutory payments (SMP/SAP/SSP)

✔ Accurate payslips

Payroll mistakes can be costly — but the right accountant prevents them.

7. Handling HMRC on Your Behalf

Nothing worries business owners more than HMRC letters, compliance checks, or investigations.

With TTAS, you never deal with HMRC alone.

We respond, explain, and resolve issues directly with HMRC on your behalf.

8. Giving You Peace of Mind

Knowing your accounts are correct, compliant, and up to date gives you confidence to run your business.

You gain:

- More time

- Less stress

- Better decisions

- More control

- Long-term stability

When your finances are handled professionally, you can finally focus on building the business you envisioned.

Why Choose TT Accountancy Services (TTAS)?

At TTAS, we support:

✔ Freelancers

✔ Landlords

✔ Sole traders

✔ Limited companies

✔ Retailers

✔ Online businesses

✔ Consultants

✔ Startups

✔ Tradespeople

Our services include:

- Bookkeeping

- Payroll

- VAT returns

- Self-Assessment

- Corporation Tax

- Business advisory

- Financial planning

- Property tax support

- HMRC compliance and audits

We help you save time, reduce tax bills, and grow with confidence.

Hiring an accountant isn’t an expense — it’s an investment in:

Growth

Time savings

Clarity

Peace of mind

Higher profits

The earlier you bring an accountant on board, the stronger your business foundation will be.

Ready to save time and grow your business?

TT Accountancy Services is here to help.

?>

?>