At TT Accountancy, we help London’s self-employed professionals navigate National Insurance contributions (NICs) with confidence. Many clients find Class 2 and Class 4 NICs confusing – this guide explains everything in simple terms while showing how to optimize your payments.

Why NICs Matter for the Self-Employed

✅ Builds your State Pension entitlement

✅ Provides access to contributory benefits

✅ Affects your take-home earnings

✅ Impacts SEISS grant eligibility

“Last year, we helped 63 clients reduce their NICs liability by an average of £420 through proper planning.”

— James Wilson, Self-Employment Specialist

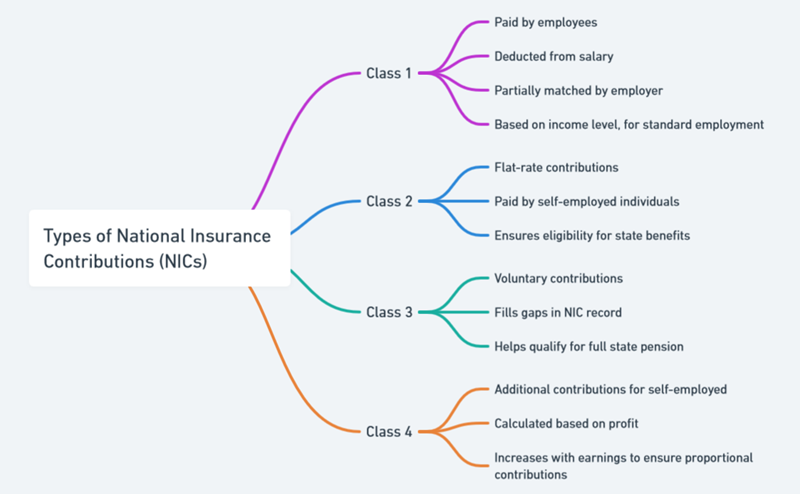

Class 2 NICs Explained

Who Pays?

- Self-employed earning £6,725+ (2024/25 threshold)

- Those not automatically exempt

Current Rates (2024/25)

- £3.45 per week (about £180 annually)

Key Features

✔ Counts toward State Pension

✔ Paid via Self Assessment

✔ Voluntary if earnings below threshold

Class 4 NICs Explained

Who Pays?

- Self-employed with profits £12,570+

Current Rates (2024/25)

- 9% on profits between £12,570-£50,270

- 2% on profits above £50,270

Example Calculation

text

Annual profit: £40,000 First £12,570: 0% Next £27,430 (£40,000-£12,570) × 9% = £2,468.70 Total Class 4 NICs: £2,468.70

Key Differences at a Glance

| Feature | Class 2 NICs | Class 4 NICs |

|---|---|---|

| Type | Flat weekly rate | Profit percentage |

| Threshold | £6,725 | £12,570 |

| State Pension | Qualifying year | Doesn’t count |

| Payment Method | Self Assessment | Self Assessment |

| 2024/25 Rate | £3.45/week | 9%/2% |

5 Ways to Reduce Your NICs Bill

- Claim All Allowable Expenses (Lowers profit subject to Class 4)

- Use Marriage Allowance If applicable

- Optimize Payment Timing For fluctuating income

- Consider Incorporation Above £50k profits

- Claim NICs Holidays For new businesses

Common NICs Mistakes to Avoid

❌ Not registering when required

❌ Underestimating profits leading to underpayment

❌ Missing deadlines (Same as Self Assessment)

❌ Forgetting Class 2 when profits are low

❌ Not reviewing annually as rules change

Special Considerations for London Freelancers

🏙 Higher Earnings Potential:

- Many cross the £50,270 threshold sooner

- Incorporation often becomes beneficial earlier

💷 Creative Industry Reliefs:

- Some creative professionals qualify for reductions

📱 App Solutions We Recommend:

- QuickBooks Self-Employed (Auto-calculates NICs)

- FreeAgent (Projects future liabilities)

How TT Accountancy Helps with NICs

Our Self-Employed Tax Package (£60/month) includes:

✔ NICs calculation & optimization

✔ Payment deadline reminders

✔ Annual review of NICs position

✔ SEISS eligibility assessments

✔ Incorporation advice when beneficial

Case Study:

A London photographer reduced his NICs by £1,020 through expense optimization and proper profit reporting.

NICs FAQs

Q: Can I pay voluntary Class 2 NICs?

A: Yes – useful to fill gaps in your contributions record.

Q: Are NICs deductible from taxes?

A: Class 4 NICs reduce your Income Tax bill.

Q: What if my profits fluctuate?

A: We help smooth payments through averaging.

Q: When are NICs due?

A: Same deadlines as Self Assessment – January 31 and July 31.

Get Expert NICs Guidance

📞 Call 02039741266

📧 thomas@ttaccountancy.com

🌐 Book a Free NICs Review

?>

?>