In the realm of financial management, “trade debtors” may sound intricate, yet they hold immense significance that every business, big or small, should grasp. At TT Accountancy, we believe in simplifying intricate financial terms, ensuring our clients are well-equipped to make informed choices. In this blog post, we’ll delve into the universe of trade debtors, unraveling their essence and the impact they wield on your business’s financial landscape.

Defining Trade Debtors:

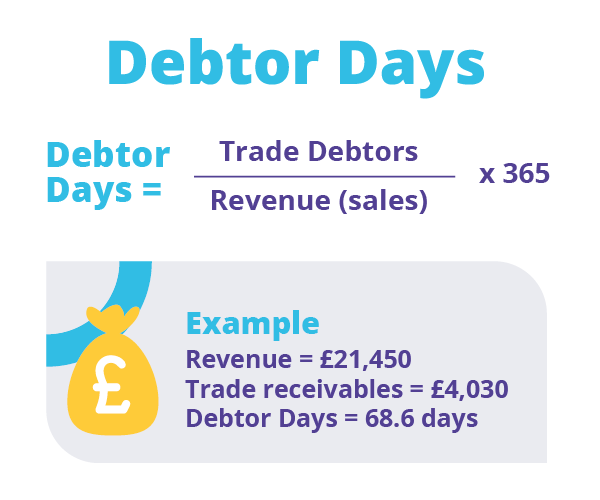

Trade debtors, also known as “debtors,” are a fundamental facet of a company’s accounts receivable. In simple terms, trade debtors encapsulate the funds owed to your business by customers or clients for products or services rendered on credit. When you vend goods or services with an agreement for deferred payment, these outstanding amounts manifest as your trade debtors.

Significance of Trade Debtors:

Apprehending trade debtors is pivotal for several compelling reasons:

- Efficient Cash Flow Management: The management of trade debtors forms the bedrock of your business’s cash flow dynamics. As these are pending payments, they directly influence your available capital. Skillful management ensures a consistent cash flow for operational expenses and investments.

- Accurate Profit Evaluation: Outstanding trade debtors directly impact your profitability. Until collected, these debts remain as unrealized revenue on your financial records. Vigilant monitoring and timely collection lead to accurate financial reporting and a transparent portrayal of your business’s actual profitability.

- Risk Mitigation: An excess of unpaid trade debtors can flag potential financial instability within your customer base. Regular evaluation of your trade debtors assists in identifying clients grappling with payment issues, empowering you to adopt preemptive measures and potentially recalibrate credit terms.

- Boosted Credibility: Effective trade debtor management bolsters your business’s credibility. Consistent, on-time payments fortify your reputation as a reliable and trustworthy entity, enhancing your appeal to potential collaborators.

Best Practices for Optimal Trade Debtor Management:

At TT Accountancy, we advocate these strategies for efficient trade debtor management:

- Transparent Credit Policies: Draft clear credit policies delineating credit terms, payment deadlines, and consequences of late payments. Transparently communicate these policies to your clients prior to extending credit.

- Regular Monitoring: Vigilantly monitor your accounts receivable to promptly identify overdue payments. Implement a robust system for sending reminders and follow-ups to clients with outstanding payments.

- Encourage Early Settlement: Consider offering incentives, like discounts, to motivate clients to settle invoices ahead of the due date.

- Seamless Communication: Maintain open lines of communication with clients. If payment challenges arise, collaborate to find tailored solutions, such as revised payment schedules.

- Structured Collection Approach: In cases of seriously delinquent debt, devise a structured collection strategy. This might encompass official collection notices, engaging collection agencies, or, as a last resort, exploring legal avenues.

In summation, trade debtors wield a pivotal role in your business’s financial landscape. Grasping their essence and employing effective management strategies ensures consistent cash flow, accurate profitability assessment, and robust client relationships. At TT Accountancy, we’re committed to steering you through the intricacies of trade debtors and other financial intricacies, propelling your business toward prosperity in today’s dynamic economic milieu. Contact us today to explore how our expertise can revolutionize your financial management approach.

?>

?>