Nick Daws takes a look at the state pension, the changes over the last few years, and how much and when you are due to receive yours.

Today I am looking at the state pension. This is a subject that concerns everyone, but may be of particular interest to readers who are approaching retirement age.

Of course, many people have one or more workplace or private pensions. However, the state pension is still a very important component of most people’s income in later life (including mine).

And unlike many workplace/private pensions, the state pension rises automatically every year at the rate of inflation or above (under the current triple lock guarantee). That makes it increasingly valuable as you get older.

In this article I’ll be revealing how to check how much state pension you are due and when. But I’ll start with a look at the changes made to the state pension in the last few years and how they affect anyone coming up to pensionable age now.

Speaking of which, let’s start with one of the biggest changes…

State pension age

It’s unlikely to have escaped your notice that the pension age is rising.

At present both men and women can access their state pension at 66. The current plan is for the age to rise to 67 between 2026 and 2028 and 68 between 2044 and 2046. The exact dates are subject to review by the government, based on average life expectancy.

You can check when you will be able to start claiming the state pension under current plans by entering your date of birth at this government website. Of course, as stated above, this could change in future.

The new state pension

This is the other major change to the state pension in recent years.

Prior to April 2016 everyone received a basic state pension (currently £156.20 a week). This was – and still is – topped up by additional state pension elements (S2P and Serps) which you accrued during your working life.

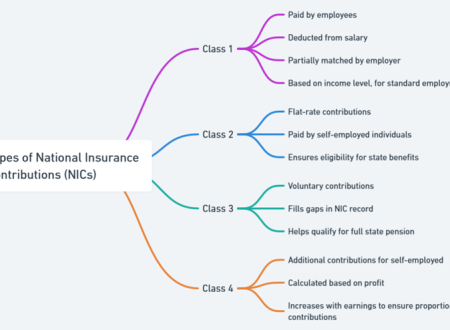

Anyone retiring from April 2016 onwards now receives the new state pension, currently worth £203.85 a week. To get the full amount, however, you will need to have about 35 years of qualifying National Insurance contributions. If you have less, you will get a reduced pension; and if under 10 years, nothing at all.

In some circumstances (discussed later) you may be able to pay a lump sum to fill in gaps in your NI record.

Checking your state pension

Anyone aged 55 or over who has lived and worked in the UK for 10 years or more (even if they are not British citizens) can visit this government website to get an estimate of how much state pension they will receive when they retire.

Doing this is a bit more involved than just entering your birthday on the pension age site mentioned earlier. You have to sign in with proof of identity, so allow a bit of time for this. If you already have an HMRC online tax account, you can use this to log in.

Once you’ve done so, you will see a forecast of how much state pension you will get once you’re eligible to start receiving it. This is based on current figures – so if you won’t reach retirement age for a few years yet, it will of course have risen by that time.

Boosting your state pension

If you’re disappointed by the amount forecast, one thing you can do to boost your state pension is defer taking it. You will receive an extra 1% for every 9 weeks you put off claiming. This works out as just under 5.8% for each year that you defer.

To benefit from this overall you should be in good health. For women especially, as their life expectancy tends to be a few years longer than men, deferring your pension (if you can afford to) could be a worthwhile option. It may also be worth deferring if you’re still working and don’t want to create an additional tax liability (the state pension counts as taxable income). .

No special action is required to defer taking your pension. You just delay claiming and it will be assumed that you wish to defer it.

Another thing you may be able to do to boost your state pension if you don’t have a full contribution record is buy extra voluntary contributions to fill any gaps.

This can be well worth doing, as typically the cost of the additional contributions will be recouped within three years. In most cases a year of additional contributions costs £824 and adds up to £302.64 each year to your pension. Most self-employed people will pay even less than this. Note that you cannot increase your state pension above the current maximum of £203.85 a week, however.

Normally you would need to do this within six years of the end of the tax year concerned. However, when the new state pension was introduced, transitional arrangements were put in place to let you plug gaps in your record all the way back to 2006. This concession was originally due to end on 5 April 2023, but due to the large numbers applying the deadline was put back several times and is now 5 April 2025. So you still have plenty of time to do this.

There’s also the question whether buying extra contributions will be cost-effective for you. This can be complicated, so I recommend checking your full NI contribution record on this government website to see where any ‘missing’ years are (remember, you can only buy top-ups for years from 2006 onwards).

You can then phone the government’s Future Pension Centre on 0800 731 0175 to discuss your options and arrange extra voluntary contributions if this would be beneficial for you.

Finally, it should be said that while the state pension provides a baseline income, on its own it won’t stretch to many (or any) luxuries. Most people will have private or workplace pensions, and perhaps other investments as well. This will be crucial if you hope to enjoy your ‘golden years’ rather than merely endure them.

As ever, if you have any comments about this article, please do post them below.

Nick Daws writes for Pounds and Sense, a UK personal finance blog aimed especially (though not exclusively) at over-fifties.

Source: mouthymoney.co.uk

?>

?>